$1800 Social Security 2025: Social Security payments to eligible beneficiaries could rise by $1,800 in 2025, a substantial increase. For millions of Americans, especially retirees, people with disabilities, and the families of wage earners who have passed away, Social Security is an essential source of financial support. This benefit increase provides much-needed financial relief over the holidays. It’s critical to comprehend the requirements for eligibility, how to confirm your eligibility, and what to anticipate from this raise. The upcoming $1,800 increase is a critical chance for recipients to improve their financial security.

Not everyone will benefit equally from the $1,800 increase in Social Security benefits; it depends on specific factors pertaining to individual earnings and eligibility requirements. The following should be understood: The $1,800 amount is the average monthly benefit enhancement due to delayed retirement credits and cost-of-living adjustments (COLA). In an effort to help beneficiaries preserve their purchasing power, rising inflation has necessitated COLA adjustments. The impact of these changes will be seen by beneficiaries in their monthly payments. Retirees, survivors, and people with disabilities are the main beneficiaries of this increase.

$1800 Social Security 2025

The United States government already offered $1800 Social Security checks to the citizens during the impact of the COVID-19 pandemic. Beneficiaries received three stimulus checks from the IRS Department of Authorities between 2020 and 2021.

Later in 2021, the IRS closed the process after successfully distributing it among the residents. But now, in 2025, people are expected to receive stimulus checks of $1800 from the department.

$1800 Social Security 2025: Overview

| Particulars | Details |

| Payment Date | On June 11, 18 or 25, 2025 (based on your birth date) |

| Eligibility Criteria | Retirees, disabled workers, spousal or survivor benefits, lifetime earnings, and age of claiming |

| Amount | Approximately $1,800 |

| Cost-of-Living Adjustment (COLA) | 2.5% COLA effective January 2025 |

| Resources | Official SSA Website for personalized benefit checks and updates |

Tamil Nadu Class 12th Compartment Exam 2025: Check Date, Timetable & More Details

Ontario Trillium Benefit Payment Arrived? Check Payment Date, Benefits & Amount

Eligibility Criteria for $1800 Social Security Payment

- A number of factors, including age, income, and the type of benefits received, affect eligibility for the $1,800 increase.

- The highest 35 years of a person’s earnings are used by Social Security to calculate benefit amounts; higher contributions result in larger monthly benefits.

- Benefits for those who retire at age 62 will be reduced; they June be as much as 30% less than the full amount.

- Depending on the year of birth, the Full Retirement Age (FRA) can range from 66 to 67 years old.

- The full retirement age (FRA) can vary from 66 to 67 years old, depending on the year of birth.

- By delaying retirement until age 70, people can accrue delayed retirement credits, which raise benefits by about 8% for every year after FRA.

- A retiree who starts receiving benefits at age 70, for example, might see an increase in their monthly payment from $2,000 at FRA to more than $2,600.

- The amount received June vary depending on eligibility for spousal or survivor benefits; spousal benefits may equal 50% of the spouse’s FRA benefit, while survivor benefits June equal 100% of the deceased spouse’s benefits.

- Benefit increases June also be possible for disabled workers who are eligible for Social Security Disability Insurance (SSDI), especially if their earnings history justifies higher payouts.

- Income levels have an impact on how Social Security benefits are taxed; people who make more than a certain amount June be subject to federal income tax on up to 85% of their benefits.

- Taxes are due when income surpasses $25,000 for single filers and $32,000 for married filers filing jointly; for individualized guidance, it is advised to speak with a tax advisor or review IRS regulations.

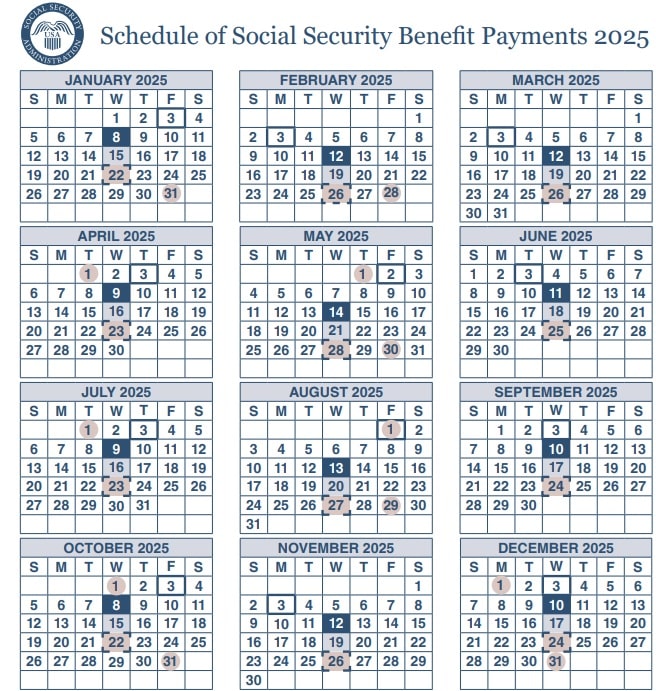

Schedule of Social Security Payments for June

The Social Security Administration calendar shows when Social Security benefits are expected to be paid for the rest of the month.

Wednesday, June 11: You will receive your SSI payment on the second Wednesday of the month if your birthday falls on any day between the first and the tenth of your birth month.

Wednesday, June 18: You will receive your SSI payment on the third Wednesday of the month if your birthday falls on any day between the eleventh and the twentieth of the month in which you were born.

Wednesday, June 25: You will receive your SSI payment on the fourth Wednesday of the month if your birthday is after the twentieth of the month in which you were born.

How Can Increase of $1800 The Social Security ?

- First, create or access your “My Social Security” account on the SSA website to see if you qualify for the $1,800 Social Security increase.

- Check your benefits statement after logging in to determine the approximate amounts of your payments.

- Review the projected benefits for early, full, and delayed retirement scenarios on your Annual Social Security Statement.

- For individualized support, call 1-800-772-1213 or stop by your local Social Security Administration office.

- Check the SSA COLA page frequently to stay up to date on annual Cost-of-Living Adjustments (COLA), as these changes can have a big effect on your benefit amounts.

Will you get a $697 direct deposit payment in June 2025? Check Next Payment Date

Singapore Government Payout 2025: Check Eligibility, Payment & Date!

Which methods work best for increasing your Social Security benefits?

- Your monthly payments June increase significantly if you wait until you are 70 years old to begin receiving benefits.

- Work together with your partner to create a plan that maximizes the overall advantages enjoyed by both of you.

- You can improve your overall earnings average by extending your working years and adding higher income periods to effectively replace lower income years.

- Speak with a financial advisor to learn more about the tax implications of your Social Security benefits and to discuss ways to reduce them.

FAQ’s: $1800 Social Security 2025

In 2025, how much will the maximum Social Security benefit be?

After the 2 percent cost-of-living (COLA) adjustment, the maximum Social Security check for 2025 is $5,108 per month, up from $4,873.

What is 2025’s highest Social Security tax?

This yearly cap is known as the contribution and benefit base. This sum is also frequently known as the taxable maximum.

What is the Social Security increase for 2025?

More than 72.5 million Americans will receive a 2.5 percent increase in Social Security and Supplemental Security Income (SSI) benefits in 2025.

What is the highest amount of the SSS pension?

The maximum SSS pension in the Philippines is Php 18,495 per month.

What are the pay dates?

Payments are made on the basis of birth date as given above in this article.

What is the taxable income threshold for benefits?

Single: $25,000

Married (joint): $32,000

Above these limits, up to 85% of benefits may be taxed.

Why did Social Security increase in 2025?

Due to inflation, SSA applied a 2.5% COLA adjustment effective January 2025 to preserve purchasing power.